Table of Contents

Understanding Overdraft Fees

Overdraft fees are charges that banks impose when a customer spends more money than they have in their account. These fees can be a significant source of revenue for banks, but they can also lead to confusion and frustration for customers. One common question that arises is whether banks can charge overdraft fees on pending transactions.

Pending transactions are those that have been authorized but have not yet posted to the account. While the funds may not be deducted immediately, they are still considered a financial obligation. This gray area often leads to misunderstandings about when and how overdraft fees can be applied.

Many banks do have policies in place that allow them to charge overdraft fees on pending transactions. This means that if a customer has insufficient funds at the time of the transaction’s authorization, they may still incur a fee even though the transaction has not fully processed yet. Customers should be aware of their bank’s specific policies regarding pending transactions to avoid unexpected charges.

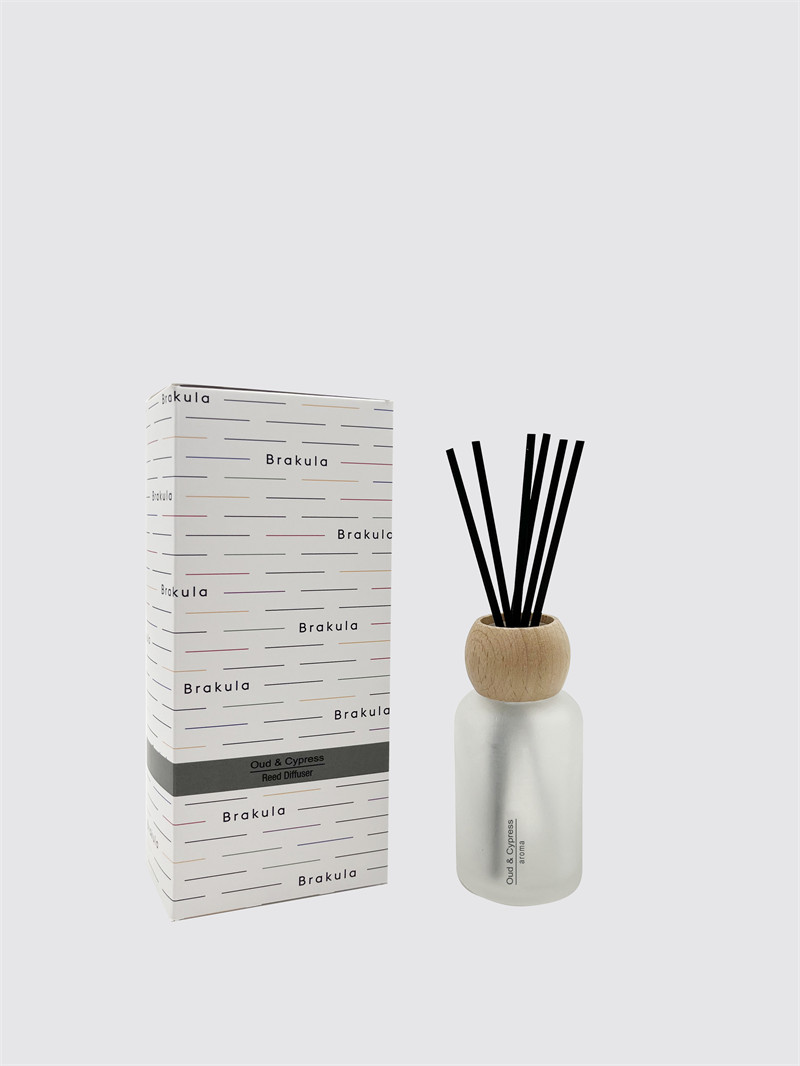

Scented Reed Diffuser Customization

Navigating Bank Policies

https://reedaromalab.com/tag/high-grade-scented-reed-diffuser-factories

Each bank has its own set of rules regarding overdraft fees and pending transactions. Some banks may choose to charge an overdraft fee at the point of authorization, while others might only apply the fee once the transaction has posted. It is essential for customers to read their account agreements and understand the terms set forth by their bank.

Additionally, some banks offer overdraft protection services that can help mitigate these fees. These services may link a savings account or line of credit to the checking account, providing a safety net for customers who occasionally overspend. However, these services may come with their own fees, which should also be considered.

Customers can take proactive steps to avoid overdraft fees by regularly monitoring their account balances, setting up alerts for low balances, and keeping track of pending transactions. By staying informed and understanding their bank’s policies, customers can better manage their finances and avoid unnecessary charges.

The Impact of Overdraft Fees

Overdraft fees can have a significant impact on a customer’s financial well-being. For individuals living paycheck to paycheck, even a single overdraft fee can create a ripple effect, leading to additional fees and financial strain. This can make it challenging for customers to maintain their budget and achieve their financial goals.

Furthermore, excessive overdraft fees can lead to a cycle of debt for some customers. When individuals rely on overdrafts to cover expenses, they may find themselves in a situation where they are unable to recover financially, leading to further reliance on bank services that carry high fees. This can result in a precarious financial situation that is difficult to escape.

| Product | Room Fragrance |

| Material | Wood |

| Suitable for | Bedroom |

| Scents | Cardamom & Nutmeg, Winter Fruit |

| Capacity | 250ml |

| Color | Indigo |

| Origin | China Supplier |

| Duration | 40-60days |

Awareness and education about overdraft fees are crucial for consumers. By understanding how these fees work and the circumstances under which they are charged, customers can make more informed decisions about their banking practices and ultimately protect their financial health.