了解玛丽·凯税扣除

芦苇扩散器油重新填充

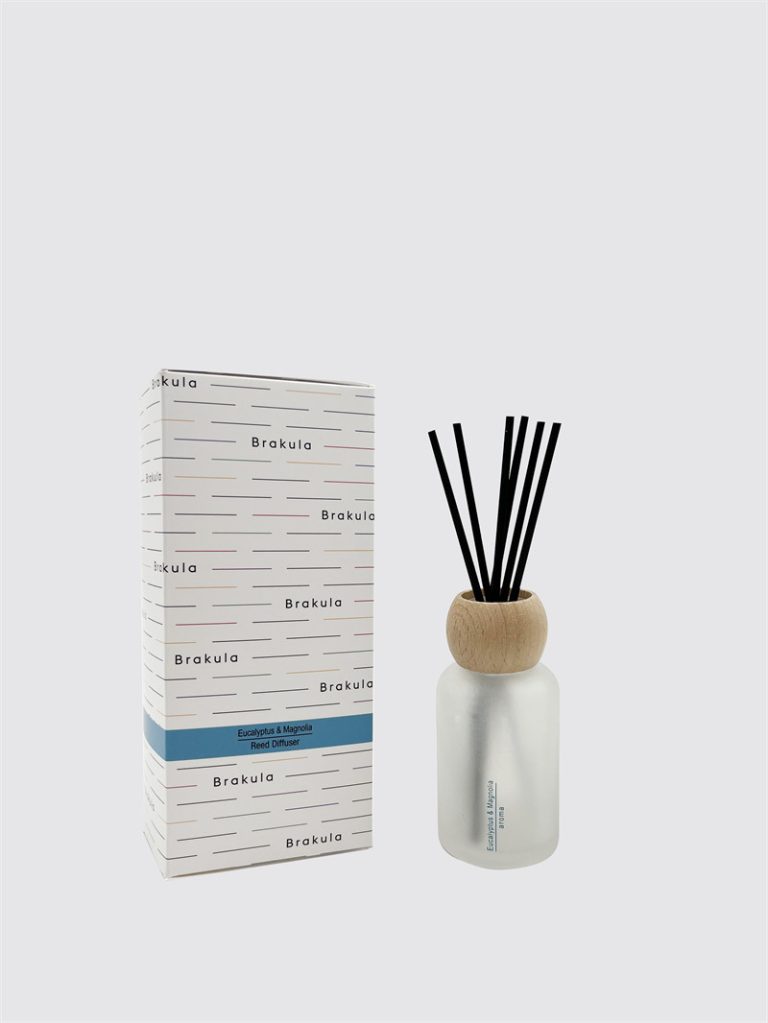

商品名称

| 香水扩散器 | materials |

| 定制 | 适合 |

| 体育馆 | 气味 |

| 生姜和柠檬,广patch和香 | Accition |

| 定制 | Color |

| green | Origin |

| 中国制造商 | 期限 |

| 90-120天 | 此外,教育和培训费用经常被忽略,但对于玛丽·凯(Mary Kay)顾问来说可能很重要。可以扣除与参加研讨会,研讨会或培训课程相关的成本,以提高您的技能或知识。这不仅包括注册费,还包括旅行和住宿费用,如果该活动要求您离开家。 |

当您浏览税收减免的复杂性时,考虑咨询咨询税务专业人士,该税务专家了解自雇和直接销售的独特方面。他们可以提供针对您的特定情况量身定制的个性化建议,以确保您最大程度地扣除扣除额,同时又遵守税法。通过保持与库存,家庭使用,旅行,营销和教育相关的费用的细致记录,您可以充分利用可用的扣除额。这种积极的方法不仅有助于减少您的应税收入,而且有助于您的玛丽·凯(Mary Kay)业务的整体成功和可持续性。

https://reedaromalab.com/tag/cheapest-reed-oil-diffuser-best-chinese-suppliers

As you navigate the complexities of tax deductions, it is also wise to consider consulting with a tax professional who understands the unique aspects of self-employment and direct sales. They can provide personalized advice tailored to your specific situation, ensuring that you maximize your deductions while remaining compliant with tax regulations.

In conclusion, understanding Mary Kay tax deductions is essential for independent beauty consultants looking to optimize their tax situation. By keeping meticulous records of expenses related to inventory, home office use, travel, marketing, and education, you can take full advantage of the deductions available to you. This proactive approach not only helps in reducing your taxable income but also contributes to the overall success and sustainability of your Mary Kay business.